Your Guide to Medicare Advantage Plans Near Me

Your Guide to Medicare Advantage Plans Near Me

Blog Article

Navigating the Enrollment Process for Medicare Benefit Insurance Coverage

As individuals come close to the phase of considering Medicare Advantage insurance policy, they are met a labyrinth of options and policies that can occasionally feel overwhelming. Comprehending the eligibility demands, different insurance coverage choices, registration periods, and the needed actions for registration can be a formidable job. Nonetheless, having a clear roadmap can make this navigating smoother and much more manageable. Allow's explore how to successfully navigate the enrollment process for Medicare Advantage insurance policy.

Eligibility Demands

To get approved for Medicare Advantage insurance, people have to meet certain eligibility requirements outlined by the Centers for Medicare & Medicaid Provider (CMS) Qualification is largely based on elements such as age, residency standing, and registration in Medicare Part A and Component B. The majority of individuals aged 65 and older receive Medicare Advantage, although particular people under 65 with qualifying specials needs might additionally be eligible. In addition, individuals should reside within the solution location of the Medicare Advantage strategy they desire to register in.

In addition, people have to be registered in both Medicare Component A and Part B to be eligible for Medicare Advantage. Medicare advantage plans near me. Medicare Benefit plans are required to cover all services offered by Original Medicare (Part A and Part B), so enrollment in both parts is essential for people looking for insurance coverage through a Medicare Benefit strategy

Protection Options

Having actually satisfied the qualification needs for Medicare Advantage insurance, individuals can currently discover the various coverage choices offered to them within the strategy. Medicare Benefit intends, also recognized as Medicare Part C, use an "all-in-one" option to Original Medicare (Part A and Component B) by supplying added benefits such as prescription medicine protection (Component D), vision, oral, hearing, and health care.

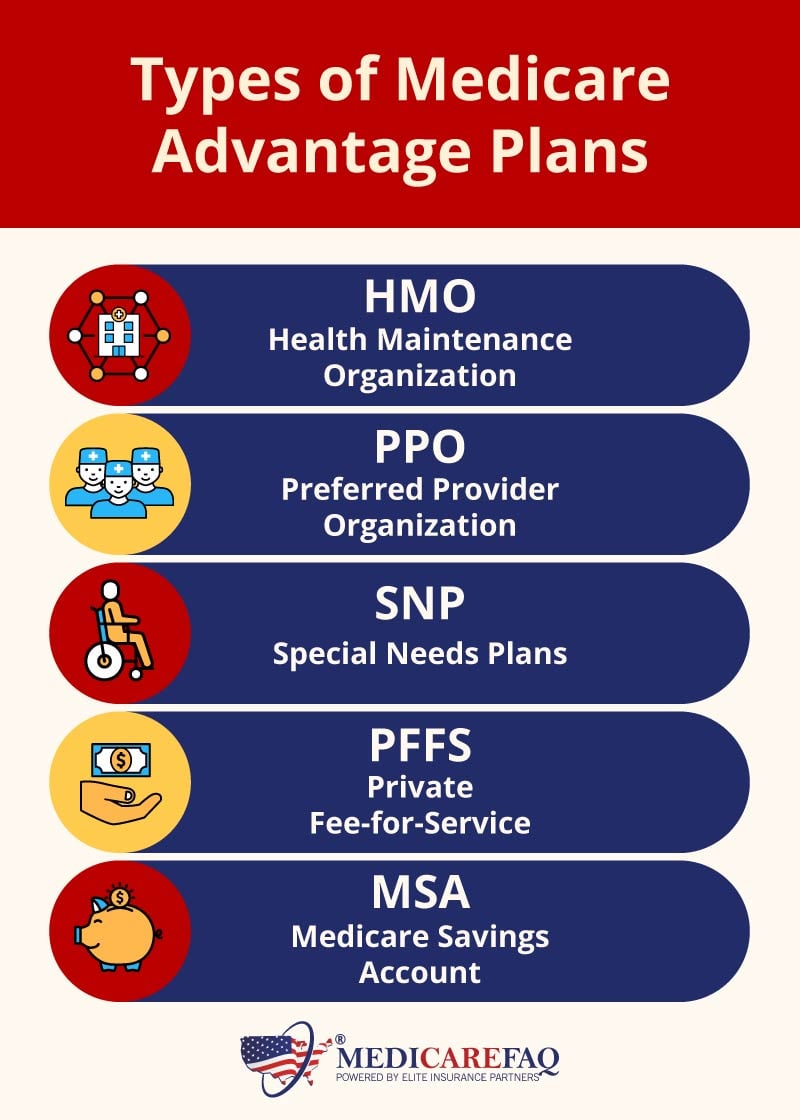

One of the main coverage options to take into consideration within Medicare Advantage intends is Wellness Upkeep Organization (HMO) strategies, which normally require people to choose a primary care doctor and get recommendations to see experts. Unique Demands Strategies (SNPs) provide to people with particular wellness conditions or those that are dually qualified for Medicare and Medicaid.

Recognizing these coverage choices is important for people to make enlightened choices based look at this website upon their healthcare demands and preferences.

Enrollment Durations

Actions for Enrollment

Understanding the enrollment periods for Medicare Benefit insurance is vital for recipients to navigate the process efficiently and properly, which starts with taking the necessary actions for enrollment. You have to be signed up in Medicare Part A and Component B to qualify for a Medicare Benefit plan.

After picking a strategy, the following action is to enroll. Medicare advantage plans near me. This can normally be done throughout particular registration periods, such as the Initial Enrollment Period, Yearly Enrollment Period, or Special Registration Duration. You can enlist directly via the insurance provider offering the strategy, through Medicare's internet site, or by speaking to Medicare straight. Be sure to have your Medicare card and individual details prepared when signing up. Examine your enrollment verification to make sure all details are exact prior to protection click site begins.

Tips for Decision Making

When reviewing Medicare Advantage intends, it is necessary to very carefully examine your individual medical care demands and monetary factors to consider to make an educated choice. To help in this process, consider the adhering to tips for decision making:

:max_bytes(150000):strip_icc()/Primary-Image-pitfalls-medicare-advantage-plans-e0b4733752d84973b8baad075834c35a.jpg)

Compare Plan Options: Research readily available Medicare Advantage intends in your area. Contrast their costs, coverage benefits, company networks, and More hints quality rankings to establish which lines up finest with your demands.

Think About Out-of-Pocket Expenses: Look past the monthly premium and think about variables like deductibles, copayments, and coinsurance. Determine potential annual expenditures based upon your health care usage to find one of the most economical alternative.

Testimonial Star Scores: Medicare designates star ratings to Advantage prepares based upon elements like client fulfillment and quality of treatment. Choosing a highly-rated strategy might suggest much better overall performance and solution.

Conclusion

Finally, understanding the eligibility requirements, coverage options, registration periods, and actions for enrolling in Medicare Benefit insurance policy is essential for making educated choices. By navigating the enrollment process effectively and considering all available details, people can ensure they are selecting the best strategy to meet their medical care requires. Making educated choices during the enrollment process can result in much better wellness results and monetary safety over time.

Report this page